We are on a mission to change the way the world does finance

Our vision is to enable the financial infrastructure of the future - one in which any financial asset can be transferred from anyone to anyone globally, in real-time, at close to zero cost.

We are on a mission to change the way the world does finance

Our vision is to enable the financial infrastructure of the future - one in which any financial asset can be transferred from anyone to anyone globally, in real-time, at close to zero cost

The problem we are addressing

Over the last 5,000+ years, the medium of exchange has evolved from a barter system to coins to banknotes to digital money. Each change has brought about a fundamental shift and enhanced efficiency in the way the world does commerce. Today, most financial assets are digital e.g. money, shares, bonds, insurance contracts.

With all its innovation, the financial system of today still has several shortcomings:

Speed: It is often not real time

Cost: It is expensive, making individual transaction costs high

Access: Every financial asset is not available to all

A key point to note is that any innovation here has to have 100% compliance with regulatory requirements such as AML, and identity verification. These are critical to deter illicit activity and preserve the integrity and stability of the financial system, and sovereign monetary policies.

We believe the problems in today's financial systems stem from the implementation of these policies (not the policies themselves), and the antiquated clearing, messaging and settlement systems which are often manual, inefficient and a key source of delay.

With all its innovation, the financial system of today still has several shortcomings:

Speed: It is often not real time

Cost: It is expensive, making individual transaction costs high

Access: Every financial asset is not available to all

A key point to note is that any innovation here has to have 100% compliance with regulatory requirements such as AML, and identity verification. These are critical to deter illicit activity and preserve the integrity and stability of the financial system, and sovereign monetary policies.

We believe the problems in today's financial systems stem from the implementation of these policies (not the policies themselves), and the antiquated clearing, messaging and settlement systems which are often manual, inefficient and a key source of delay.

The Future of Finance

We strongly believe there’s a different way. A different way for the financial infrastructure of the world to operate. A different way for the world to transact.

We are enabling a financial infrastructure for the future - one which includes:

At Roma, our immediate focus is bridging the gap between fiat and digital assets for institutions around the world. We are early in this global journey. However, as is famously said, “Change happens gradually at first, and then suddenly”. Join us on this mission to change the way the world does finance!

We are building for a world where any financial asset can be transferred from anyone to anyone globally, in real-time, at close to zero cost.

We are enabling a financial infrastructure for the future - one which includes:

- Tokenization: New form factor for all financial assets, transactions and investments

- Seamless co-existence: Fiat and tokenized assets co-exist seamlessly. Businesses and individuals are indifferent to form-factor and optimize for cost, speed and access

- Verifiable identity: Identity is universal, biometric-based and instantly verifiable for all digital or on-chain identity transactions

- Improved systems: There is a significant improvement in the clearing, messaging, settlement systems and ledger technologies that have existed for decades

At Roma, our immediate focus is bridging the gap between fiat and digital assets for institutions around the world. We are early in this global journey. However, as is famously said, “Change happens gradually at first, and then suddenly”. Join us on this mission to change the way the world does finance!

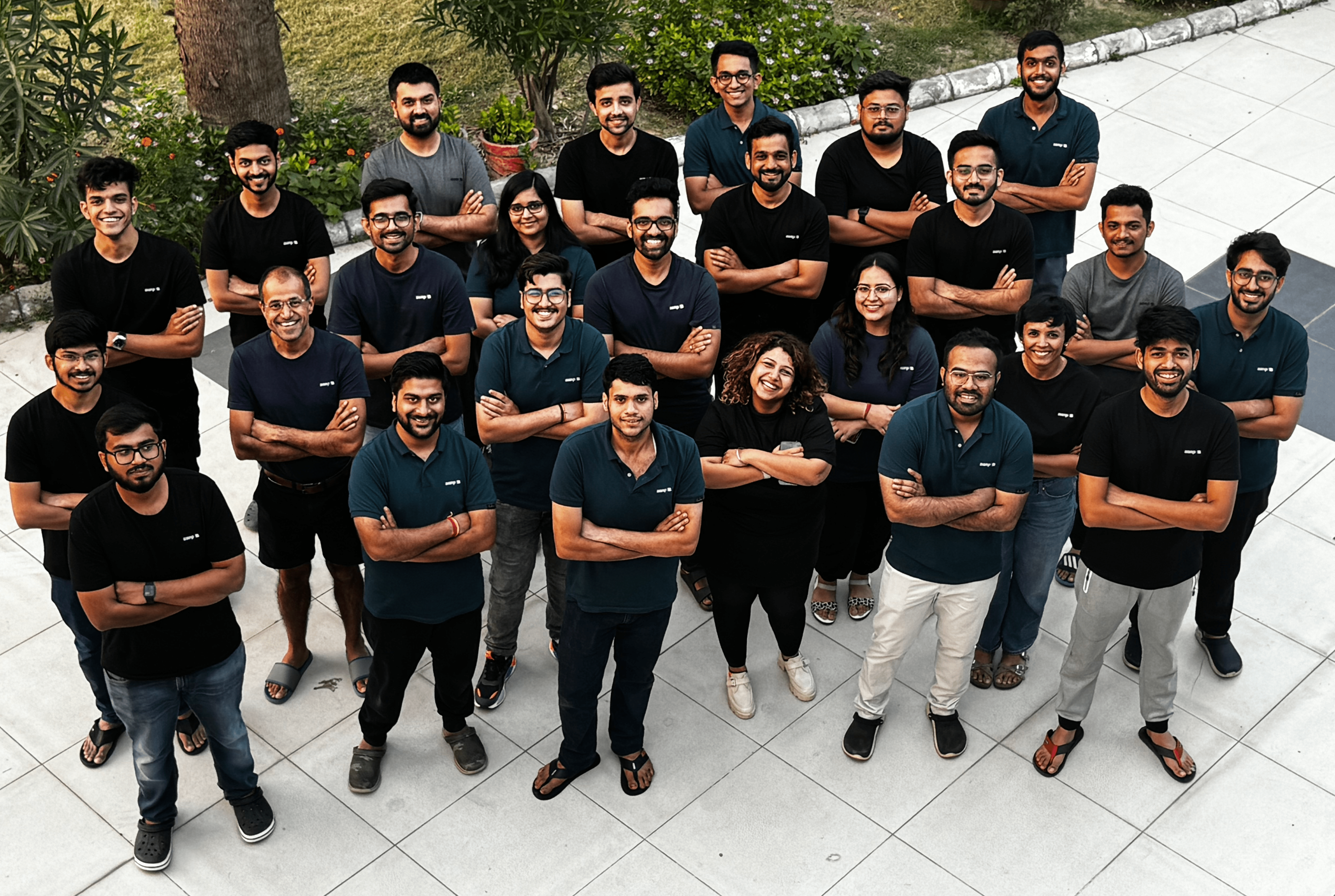

Our team

We’re building a special team for this mission.

We’re assembling the world’s best team to revolutionize finance. We are thinkers, builders, and artists who challenge the status quo and solve problems from first principles.

Our team includes leaders with experience from high-growth environments like Uber, Stripe, Facebook, and Microsoft, as well as talented individuals without prior experience. What unites us is not our resumes, but our creativity, reasoning abilities, and passion.

We value:

We believe in transparency, open communication, and empowering our team to act with urgency and build fearlessly. We are committed to creating a product that our customers love fanatically.

Join us and be part of a team that’s not just working on a product, but on transforming how the world does finance. Are you ready to make an impact and help shape the future?

Our team includes leaders with experience from high-growth environments like Uber, Stripe, Facebook, and Microsoft, as well as talented individuals without prior experience. What unites us is not our resumes, but our creativity, reasoning abilities, and passion.

We value:

- Creativity over credentials

- Reasoning abilities over experience

- High agency, passion and optimism

- Attention to detail and an owner’s mindset

We believe in transparency, open communication, and empowering our team to act with urgency and build fearlessly. We are committed to creating a product that our customers love fanatically.

Join us and be part of a team that’s not just working on a product, but on transforming how the world does finance. Are you ready to make an impact and help shape the future?

We are hiring

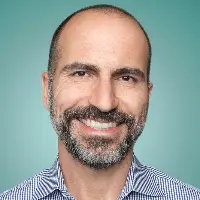

Our

Founder

Our founder, Amit Jain, was previously a managing director at Sequoia Capital, where he led investments in fintech across MENA, SEA and India. Prior to that, he led Uber in Asia Pacific, one of the fastest growing regions for Uber globally.

Linkedin

Our Founder

Our founder, Amit Jain, was previously a managing director at Sequoia Capital, where he led investments in fintech across MENA, SEA and India. Prior to that, he led Uber in Asia Pacific, one of the fastest growing regions for Uber globally.

Linkedin